|

Getting your Trinity Audio player ready...

|

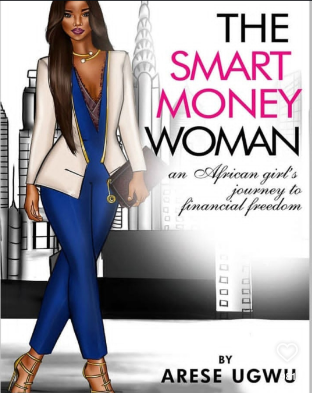

In a world where women’s financial literacy is overlooked, Arese Ugwu’s books, The Smart Money Woman and its sequel, The Smart Money Tribe, emerge as refreshing, timely, and relatable guides to achieving financial freedom for the modern African woman. These two books are not mere finance books—they are narratives that weave money lessons into the everyday lives of career-driven, ambitious women navigating love, work, and societal expectations.

At the core of Arese’s book is the advocacy for the financial independence of women. The author uses Zuri and her string of friends to debunk the idea that women must be rescued financially and depend on men for their upkeep. Both books stressed that it’s not wrong for women to want their own money, investments, and businesses. In both books, romance is spotlighted through a feminist lens– Zuri breaks away from a man who disrespects her financial growth, Tami questions the sustainability of dating someone threatened by her creativity and hustle, and Ladun discovers the limitations of relying on a man who controls the money. In simple terms, the women were able to grow and own their money.

Although Zuri starts as one of Lagos’ big girls who appears to have it all, her brokenness reawakens her to invest and own her money, reinforcing that modern femininity is built on commercialism and performance. Zuri’s insistence on being seen for her work quality and intelligence rather than femininity reflects that a woman is never greedy for wanting, nor should her worth be based on appearance.

Arese didn’t teach women how to build their personal finance. She implanted a money mindset– that builds assets, aligns finances with life goals, and value budgeting. Every chapter ends with practical Smart Money Lessons and exercises that guide readers to assess their own spending habits, debt, savings, and investment options.

The characters of Zuri, Ladun, Tami, Adesuwa, and Lara mirrored the financial struggles of African women. Their experiences are a perfect example for African women to take charge of their lives and finances.